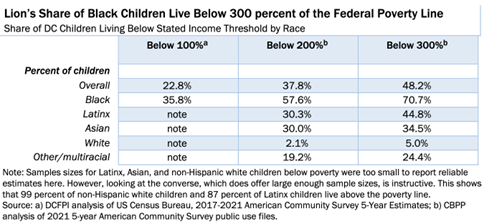

This month, we got our first look at the City Council’s FY24 budget proposal. In their response to Mayor Bowser’s submission, which left the Baby Bonds program entirely unfunded, the Council has reinstated $54 million for the program over the next four years. The intention of the Baby Bonds program is to “to provide a subsidized wealth building and investment account” for children in the District whose families earn below 300% of the federal poverty line. The Council deserves credit for restoring full funding for this program. However, if they are serious about building these children’s wealth, they must go further. Building wealth requires interventions both to support long term asset building and immediate income needs. To do so, the District should pair the Baby Bonds program with a monthly, refundable Child Tax Credit.

Wealth, defined as “the total financial value of what an individual or household owns (assets) minus all debts (liabilities),” shapes our lifespan; our access to medical care, safe housing, education, and employment opportunities; our vulnerability to exploitation; the care we can provide to our parents as they age; and the opportunities we can offer our children. Given our nation’s long history of white supremacy, it is not surprising that an enormous racial wealth gap between Black and white individuals, families, and communities persists. Nationally, the average white household has ten times the wealth of the average Black household. In Washington D.C, the gap is even greater. The City’s Council Office of Racial Equality (CORE) reports that the median wealth of white families ($284,000) in the District is a stunning 81 times higher than the median wealth ($3,500) of the District’s Black families. This racial wealth gap drives the disparate outcomes of DC’s Black and white populations, across lifespans and generations. The enormous importance of wealth in shaping our life trajectories demands that we do all that we can to close the gap.

The Baby Bond program is one significant step the District has taken towards that goal. Because of the disproportionate share of Black families in DC living below 300% of the Federal Poverty Line, this program’s benefits primarily flow to the Districts’ Black residents and other residents of color. The program provides $500 at birth, plus up to $1000 a year in a trust fund to all children below the income threshold, until they gain access to the fund at 18. Children can use their trust fund to pay for education expenses, buy a home or commercial property, start or maintain a business, or invest in retirement savings, such as by purchasing stocks or bonds.

Source: DC Fiscal Policy Institute, “A Child Tax Credit Would Reduce Child Poverty, Strengthen Basic Income, and Advance Racial Justice in DC,” 2023

Access to higher education, homeownership, entrepreneurship, and retirement savings are all, undeniably, important components of a person’s wealth-building capacity, and providing low-and moderate- income youth, particularly Black youth, with access to these wealth-building opportunities is a worthwhile endeavor. Overall, CORE scored the program as having the potential to advance racial equity in its Racial Impact Equity Assessment (REIA).

However, the Baby Bond program leaves untouched an equally critical element of a child’s future economic potential: their families’ income. To comprehensively invest in closing the racial wealth gap, the District must also invest in supporting low-income families’ immediate financial needs.

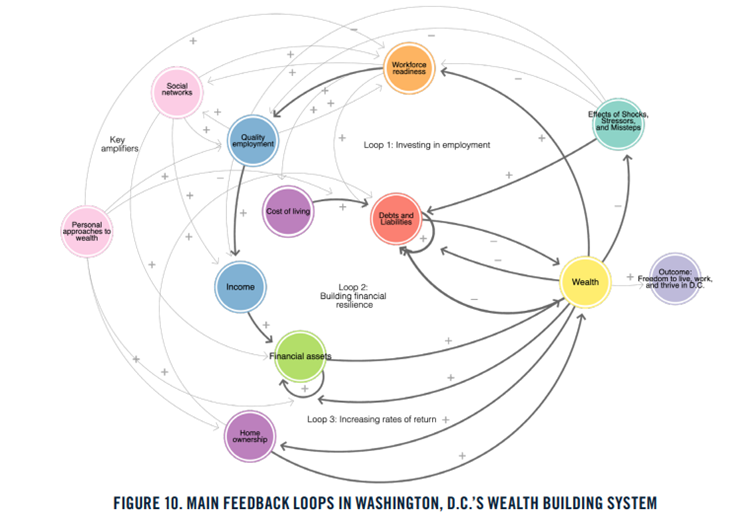

In 2021, CORE commissioned a report on the racial wealth gap in DC. The report engaged in a systems-level analysis of the City’s racial wealth gap, exploring the factors that impact wealth building, organizing them into categories, and exploring the relationships between them. The report identified three main feedback loops that act together to positively or negatively impact individuals’ wealth-building capacity. These include employment, financial resilience, and rates of return from assets. These loops are mutually reinforcing. For example, securing a high-paying job (employment) allows individuals to purchase a home, which will increase in value (rate of return from assets), allowing the individual to better weather financial hardships (financial resilience), as well as invest in educational opportunities, which may allow them to advance their career even further (employment). Crucially, a critical component of all three loops is income. Without sufficient income, none of these loops work. Wealth is more than income, but without adequate income, building wealth is an impossible task.

An extensive body of research has shown that parents’ income is directly related to their children’s future earning potential. Research has found that an extra $3,000 in a family’s annual income when a child is younger than age 5 leads to 19% higher future earnings. Another study found that when mothers with low incomes received just over $300 in monthly cash assistance during the first year of their children’s lives, their infants’ showed significantly more brain activity associated with higher language and cognitive scores and better social and emotional skills. Children who grow up in poverty are more likely to experience adverse childhood experiences (ACEs), which are, in turn, linked to higher unemployment levels and higher rates of poverty. Even the Centers for Disease Control has said that “policies that strengthen household financial security (e.g., tax credits, childcare subsidies, other forms of temporary assistance, and livable wages) … can prevent ACEs by increasing economic stability and family income.”

In other words, offering low-income children access to wealth building assets when they turn 18 is not enough to close the wealth gap. In order to thrive, children need to grow up in financially secure environments where their basic needs are met. They need to have the freedom to explore their talents and develop their skills. They need parents with the time and energy to engage with them. Baby Bonds do nothing to meet these needs. Pairing them with a strong Child Tax Credit would give DC’s low-income children a strong start, and a solid future.